TRX Price Prediction: How High Will TRX Price Go?

#TRX

- TRX trades above its 20-day moving average, indicating bullish near-term momentum

- MACD shows positive divergence, supporting potential upward price movement

- Growing popularity and positive ecosystem developments provide fundamental support

TRX Price Prediction

Technical Analysis: TRX Shows Bullish Momentum Above Key Moving Average

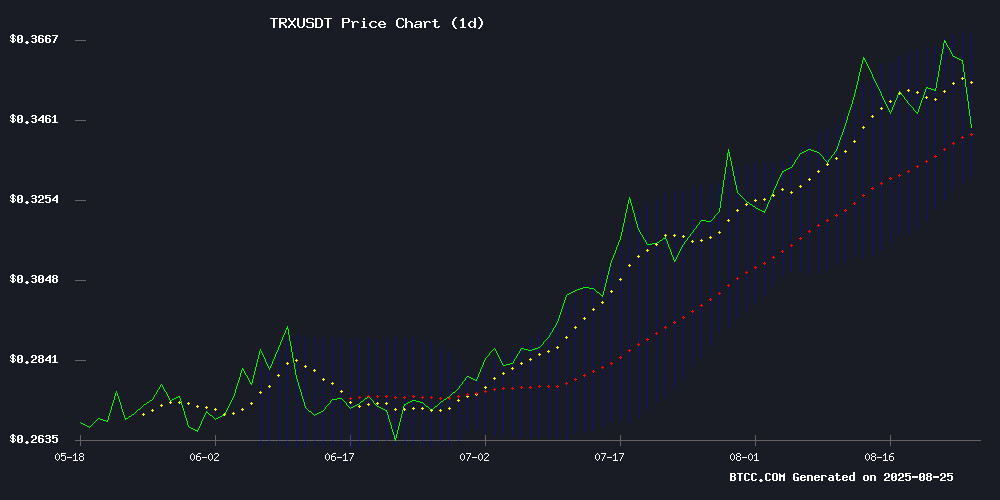

TRX is currently trading at $0.3529, positioned above its 20-day moving average of $0.35037, indicating underlying bullish momentum. The MACD indicator shows a slight positive divergence with a histogram reading of 0.000525, suggesting potential upward movement despite remaining in negative territory. Bollinger Bands reveal price action NEAR the middle band with room to test the upper resistance at $0.3686. According to BTCC financial analyst Emma, 'The technical setup suggests TRX could challenge the $0.368 resistance level if buying pressure sustains above the 20-day MA support.'

Market Sentiment: TRX Benefits from Growing Investor Interest and Ecosystem Developments

TRX ranks among the top 10 tokens by popularity, reflecting sustained investor interest alongside major assets like SOL and USDC. The involvement of crypto mogul Justin Sun with Micronation Liberland's recognition efforts adds positive sentiment to TRX's ecosystem. Stablecoin inflows driving Layer-1 competition may indirectly benefit TRX's network activity. BTCC financial analyst Emma notes, 'While news sentiment is generally supportive, technical levels should remain the primary guide for near-term price targets as market enthusiasm needs confirmation through sustained buying pressure.'

Factors Influencing TRX's Price

Top 10 Tokens Leading Popularity: SOL, TRX, USDC, BIO, CXT & Others Attract Investor Interest

Solana (SOL) dominates social media engagement, reflecting its bullish market performance with a 17.5% monthly gain. Tron (TRX) follows closely as altcoins rally amid broader crypto market growth.

LunarCrush data reveals surging community interest in emerging protocols like FLIP and PROMPT, signaling shifting capital flows beyond blue-chip assets. Stablecoin USDC's inclusion highlights demand for yield-bearing SAFE havens during volatile price action.

Micronation Liberland Bets on Crypto Mogul Justin Sun to Win Global Recognition

Justin Sun, the Chinese-born crypto billionaire behind Tron, has taken on the role of prime minister in the self-proclaimed micronation Liberland. Elected in 2024 and reelected multiple times since, Sun's leadership signals a strategic push for international legitimacy. Liberland, founded in 2015 on contested land between Croatia and Serbia, has long struggled for recognition. Croatian authorities dismiss it as a fringe project, yet it has cultivated a loyal following among libertarians and crypto enthusiasts.

The micronation’s survival hinges on crypto donors and blockchain-based governance experiments. Sun’s political connections, including ties to Donald Trump, could prove pivotal in securing U.S. backing. Liberland’s founder, Czech politician Vít Jedlička, envisioned it as a refuge from overregulated democracies. Despite repeated evictions and minimal infrastructure, the project persists—a testament to the ideological fervor driving its supporters.

This Week’s Top 10 Crypto Gainers: OKB Leads as MORPHO, AAVE, ARB, and JTO Rally

Cryptocurrency markets showcased resilience this week, with several digital assets posting significant gains despite ongoing volatility. OKB, the native token of the OKX exchange, surged 64.20% to lead the pack, reaching an all-time high of $255.50 on August 22, 2025. The token’s 318% two-week rally reflects growing demand and constrained supply.

MORPHO, AAVE, ARB, and JTO followed closely, drawing investor attention with their innovative protocols and ecosystem developments. Solana (SOL) and Ethereum (ETH) maintained momentum, while chainlink (LINK) and Tron (TRX) rounded out the top performers. Pendle (PENDLE) completed the list, underscoring DeFi’s continued relevance.

Exchange activity remained concentrated on Binance, OKX, and Bybit, where liquidity and trading volume supported the rallies. The breadth of outperforming assets—spanning exchange tokens, LAYER 2 solutions, and DeFi platforms—highlights the market’s multifaceted growth drivers.

Stablecoin Inflows Drive Layer-1 Blockchain Competition

Stablecoin supply has more than doubled in less than two years, surging from $130 billion in January 2024 to $270 billion today. Tether (USDT) remains the dominant player, while Circle (USDC), Ethena (ENA), and Sky (SKY) carve out their shares. This exponential growth is reshaping the competitive landscape among Layer-1 blockchains.

Ethereum (ETH) and Tron (TRX) collectively control 90% of stablecoin supply, with Solana (SOL) emerging as a strong third contender after crossing the $10 billion threshold. Smaller chains like BNB Chain, Avalanche, and Layer-2 solutions such as Arbitrum One and Base are gradually capturing incremental flows. The race for stablecoin liquidity is intensifying, potentially explaining recent price divergences among L1 networks.

Bitcoin Hyper Presale Raises $11.5M for First-Ever Rollup Bitcoin L2 Amid Market Shift

Bitcoin's price dipped 0.8% to $114,700 despite favorable macroeconomic conditions, extending its weekly loss to 2.9%. The selloff contrasts with altcoin resilience—Ethereum gained 1.2% today and 6.8% weekly, while Solana rose 2.2% daily and 8.6% weekly. Capital appears to be rotating toward higher-growth alternatives as Bitcoin dominance hits an eight-month low of 58%.

Bitcoin Hyper ($HYPER) exemplifies this trend, securing $11.5 million in presale funding at a $300,000 daily pace. The Layer-2 solution aims to address Bitcoin's scalability limitations, attracting institutional and retail interest. Market dynamics suggest accelerating demand for altcoins with tangible utility, as evidenced by ethereum and Solana's outperformance during Bitcoin's consolidation.

How High Will TRX Price Go?

Based on current technical indicators and market sentiment, TRX shows potential for upward movement toward the $0.3686 resistance level (Bollinger Upper Band). The price currently trades above the 20-day moving average ($0.35037), providing near-term support. Positive MACD divergence and TRX's inclusion among top popular tokens suggest growing investor confidence.

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $0.3529 | Above 20-day MA support |

| 20-day MA | $0.35037 | Key support level |

| Bollinger Upper | $0.3686 | Near-term resistance target |

| MACD Histogram | +0.000525 | Bullish momentum building |

BTCC financial analyst Emma suggests: 'A break above $0.3686 could open the path toward $0.38, though traders should monitor for sustained volume to confirm the breakout.'